What Comes Next: (Re)Inflation?

Don’t call it a comeback, I been here for years; I’m rockin’ my peers, puttin’ suckers in fear.

LL Cool J

Corona Crisis vs. Great Financial Crisis (GFC)

There have been numerous comparisons made between the economic effects of the 2008-2009 GFC period and the COVID-19 crisis (starting around Feb/Mar 2020 timeframe). Many have noted the similarities during both timeframes of loose monetary policy, ultra-low interest rates, asset price drawdowns along with subsequent rebounds, high unemployment, and other aspects of both the capital markets and real economy. One aspect that garnered much attention post-GFC was the fact that inflation (as defined by the U.S. Bureau of Labor Statistics as “CPI”) did not appear to increase very much, if at all, despite large amounts of Federal Reserve Quantitative Easing (“QE”, or essentially the Fed infusing liquidity into the banking system via large purchases of Treasuries or other high quality private sector securities such as MBS). (Arguably, however, inflation came about through other forms such as monetary inflation and asset price inflation, which we’ll touch upon further below.) Many have noted that given the similarities between the COVID-19 crisis and the GFC that, since price inflation did not appear post-GFC, it may very well not appear as the COVID-19 crisis gradually comes to a conclusion.

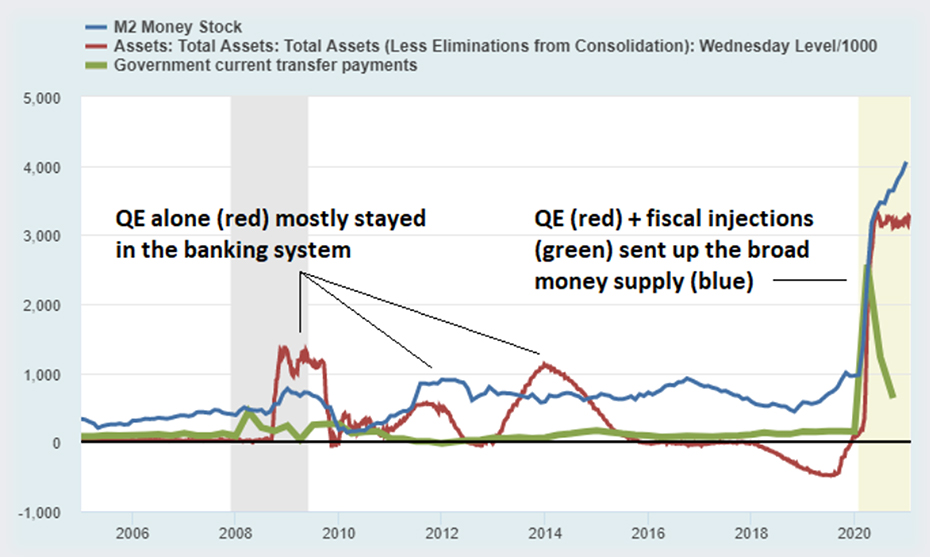

There may be however a specific distinction between the two crises which could imply a major difference in reasonable inflation expectations. During the GFC, while there was large amounts of QE which infused the bank system with much-needed additional banking reserves (effectively recapitalizing the banks), the broad (M2) money supply in the real economy did not increase very much. Put another way, monetary policy alone was not enough to trigger inflation in the prices of goods and services. During the immediate post-COVID-19 period; however, the U.S. Treasury printed large budget deficits for stimulus payments (which the Fed funded through notes). The difference in broad money supply can be seen below:

Notably, while the Fed’s balance sheet increased during all of its periods of QE, only during the most recent COVID-19 crisis did M2 money supply increase meaningfully. We have already witnessed at least one side effect of this money supply, that is, asset price inflation (equities, bonds, commodities, gold, etc.), side by side with monetary inflation. The question relating to whether price inflation could potentially increase is dependent on whether that broad money supply gets spent by consumers on goods and services at a rate that could result in supply/demand imbalances and therefore rising prices.

Against an approximately 25% increase in broad money supply are lined up several deflationary forces which have been particularly exacerbated since COVID-19 including:

- Technological developments which have greatly reduced economic production costs

- Labor offshoring which has over time reduced wage pressure in the US

- Large demand shocks for certain goods and services due to Covid-related economic shutdowns

The overwhelmingly large money supply increase due to U.S. government stimulus however seems to be resulting in higher inflation expectations as the economy begins to see light at the end of tunnel for the COVID-19 healthcare crisis, and some of the deflationary forces which existed during the height of the COVID-19 crisis begin to subside. 10-year Treasury yields (widely viewed as a leading indicator of forward-looking short term interest rate expectations) have recently climbed to as high as 1.4%, which, while low in absolute historical terms, is a meaningful % increase from approx. 0.66% at the beginning of 2021, and the highest level since the past 12 months. Those interest rate expectations, in turn, form the expected view of what would be needed to keep the U.S. economy from over-inflating (prices rising too quickly).

What Will the Fed Do

The Fed has publicly stated that they wish to reflate the U.S. economy to an average rate of 2% inflation over a longer-term time horizon. In effect, the Fed is both signaling (through verbal and written testimony before the Senate Banking committee as recently as February 24, 2021 1 ), as well as acting through continued QE and Fed funds rate anchoring, that it would like to see increased inflation. Higher inflation would indicate improvement in economic activity, the velocity of money supply, and ultimately higher productivity in the form of improved GDP measurements. However, over longer periods of time, too much inflation would also require increased rate hikes in order to manage inflation to a level which is stimulative to the economy but not overinflated.

What the Fed appears to be willing to tolerate post-COVID-19 is a longer “grace” period during which to allow higher inflation. By using a targeted average 2% over multiple years, the implication is that in some years inflation could rise above 2%, but the Fed still would not raise short term rates.

Over the near-term time horizon (12-18 months), a combination of higher inflation and potentially higher Treasury rates (if enacted) could impact the risk-adjusted value of fixed rate credit investments, as higher rates reduce the value of coupons and inflation reduces the real value of principal repayments.

Footnotes