Potential Consequences of Government Intervention

It has been said that Democracy is the worst form of government except all those other forms that have been tried from time to time.

Winston Churchill

COVID-19

On March 27th, 2020, the US Congress passed the $2.2T economic stimulus bill known as the CARES Act, thus formally beginning the process of government intervention to help combat COVID-19’s unprecedented effects on the US economy. The US Federal Reserve for its part augmented the fiscal response with monetary stimulus starting on April 9th, 2020, beginning with the launch of up to $2.3T in lending facilities, including its PPP program, Main Street Lending Program and other capital markets facilities (e.g., PMCCF, SMCCF, TALF, and others).

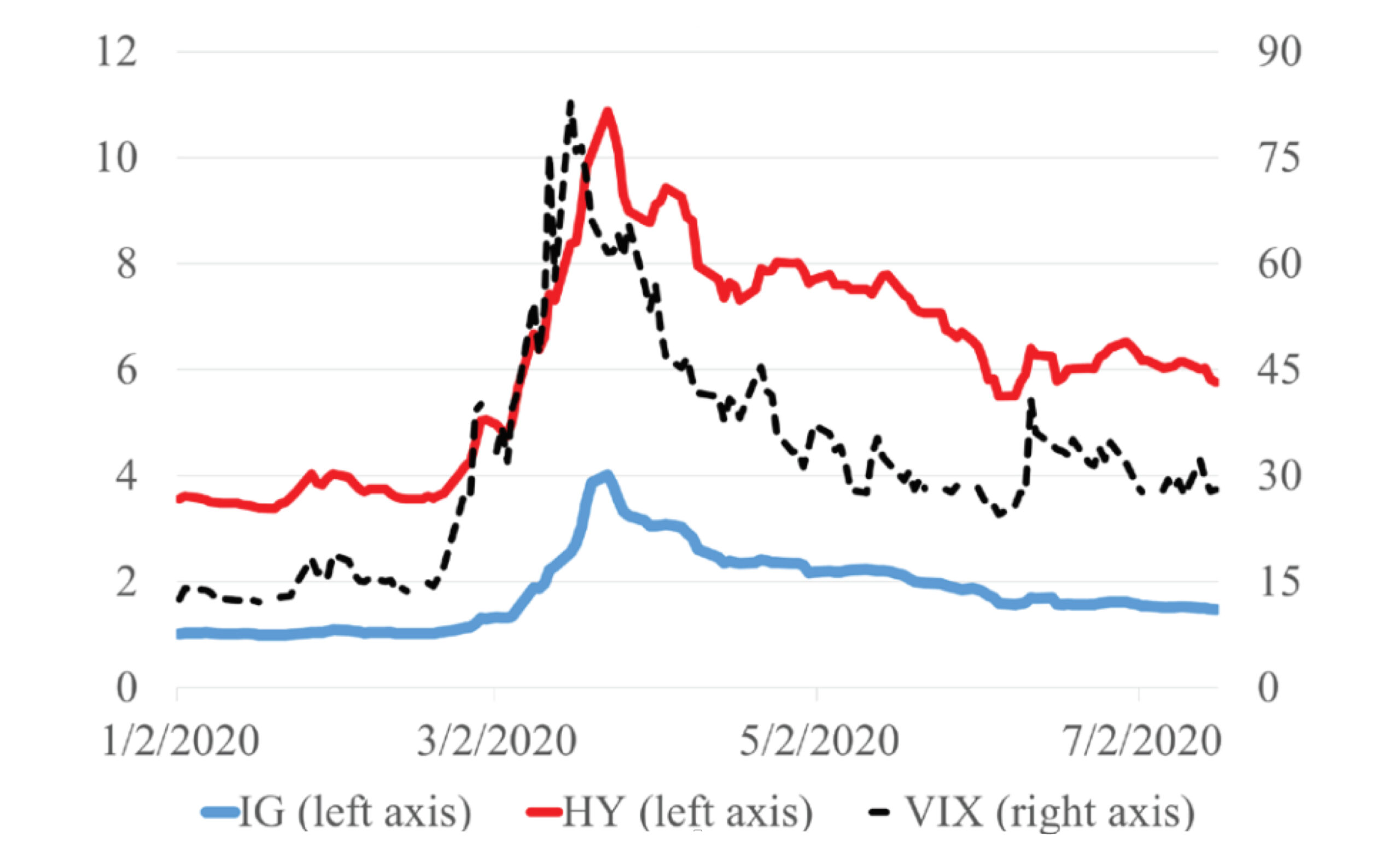

As a result of these stimulus programs, as well as subsequent aid from the government (including fed funds rate cuts, and additional quantitative easing), the initial volatility of corporate credit markets (as measured by IG and HY bond spreads) provoked by COVID diminished fairly quickly and continued to decrease over the course of 2020 (though to date not yet incorporating the most recently proposed stimulus bill of ~$900B) (Exhibit 1).

Exhibit 1: IG and HY bond spreads during early time of COVID

Clearly, the government intervention was needed and crucial to the facilitation of normalized US credit market liquidity. Government intervention appears to have effectively performed its intended role, as capital markets activity has continued fairly smoothly throughout the remainder of 2020 thus far. In fact, due in no small part to government intervention, 2020 has become a year of record-setting corporate debt markets issuance (Bloomberg, August 17, 2020). That said, perhaps it is worthwhile asking whether government intervention had any unintended consequences which will result in some currently as-yet-unpriced negative externalities which will come to bear on our economy in the future.

Government Debt

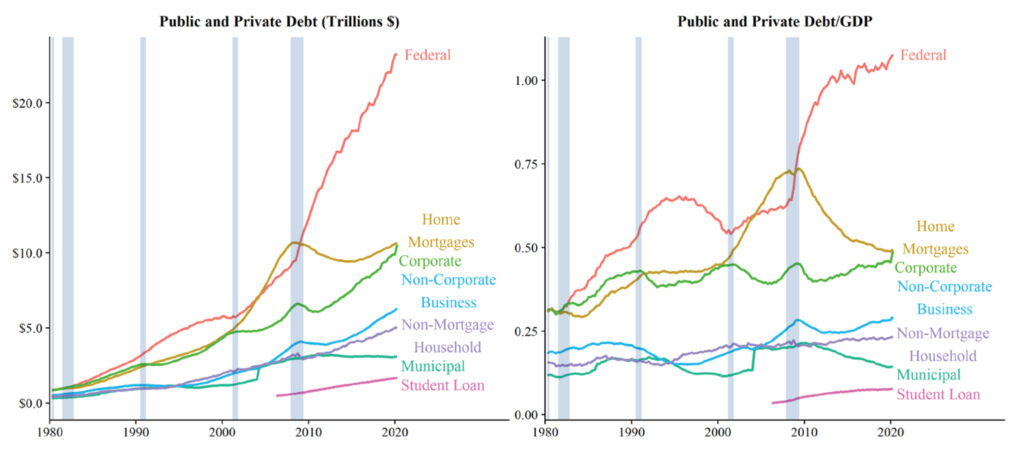

There has been no shortage of publications discussing the increasing and, on an absolute basis, record-setting levels of US government debt which has arisen recently (Exhibit 2).

Exhibit 2: Public and private debt levels

Of course, US government intervention has a price tag, as measured in USD debt, and while there can certainly be debate (primarily by Modern Monetary Theory proponents) as to whether that debt has the ability to present a future drag on the US economy, there can be no disputing the clear data of extremely high, and growing, levels of government debt (on an absolute basis, relative to GDP, and via other measurements).

Picking “Winners” and “Losers”

If as a society we agree as a matter of public policy, that for certain exogenous events, particularly those outside of human control (e.g., global pandemic), that government economic intervention is a ‘necessary evil’, this begs the question of how best to administer that intervention. Recent history seems to indicate that the US Treasury and Federal Reserve have deemed it best to, (effectively, though perhaps unintentionally) pick “winners” and “losers”. That is, to enact policy measures which, inadvertently, might facilitate more capital flows to certain stakeholders in the economy, as compared to others. As has been widely noted in the press, US Covid-related stimulus efforts seem to have had the unintended effect of facilitating relatively more capital to those deemed more credit-worthy recipients (generally larger cap and/or publicly traded companies), while facilitating less capital on a relative basis to those that might be considered less credit-worthy (generally smaller, closely held businesses). This differentiation may have the effect of exacerbating competitive advantage in favor of certain companies due to easier capital access (as directed by policy mandate) in times of crisis as opposed to allowing market forces play out (which could over time result in different outcomes). In effect, those who already “had” (good credit quality) received relatively more, while those who “had not” (lower credit quality) received relatively less, thus accelerating differentiation between the “haves and have nots”.

There may be methodologies that more evenly distribute aid across the entire credit spectrum (say, just by way of one example, provide capital access based on an equal % of pre-crisis revenues or costs to all businesses)—but that would involve a decision by the government to proactively take on credit risk. The question of whether intervention should prioritize equal capital access in times of crisis or whether to accept credit risk (and how much) is just one of the difficult tradeoffs inherent in government policy.

Centralized vs. Decentralized Decision-making

One of (if not the) most important aspects of capitalist markets is the mechanism of using the information gathered by many market participants (e.g., decentralized decision-making) to determine asset prices. Once government intervention occurs (albeit even if a necessary evil during exogenous events), decision-making as it relates to that particular policy is centralized (government-driven). ‘Normal’ market activity will occur, by definition, only within the framework set out by the limitations of that government intervention.

By way of example, in the case of Covid in the midst of 2020, federal government capital stepped in to partly ‘compete’ with private sector capital and helped drive credit spreads tighter than they otherwise would have been without government capital. Federal capital in essence created a ‘floor’ for asset pricing which the private sector capital markets then reacted to by pricing in the floor created by federal capital. Thus, even more fundamentally than the ‘winners vs. losers’ issue previously discussed, federal capital distorted to some extent virtually all natural pricing signals by ‘lifting all boats’ (albeit some more than others). By centralizing the decision to determine this pricing floor, federal policy effectively forced private sector market participants to abide by the framework determined by policy, as opposed to allowing participants to independently engage in typical price discovery processes.

Government ‘Signaling’

Government intervention can seem even more striking when considering the fact that relatively little actual spending was needed (many of the Fed’s facilities have been far less than fully drawn), relative to the full ‘signaling’ effect of Fed policy—the implicit ‘guarantee’ that, should private sector capital markets withdraw liquidity, the Fed would backstop all assets. In actuality, the effect of government policy in the capital markets far exceeds the actual dollars spent by the government, since only a small percentage of the capital that provided liquidity during the Covid-19 crisis was government capital, with the remainder comprising of private sector capital.

Thus, private sector capital is simply following the lead which government signals are disseminating. The question remains, however, as to whether government price signaling accurately reflects true asset valuation or whether its’ centralized price signaling will prove to be incorrect. The common refrain is that, by signaling an (arguably) artificial floor for asset pricing, could the government simply be leading a process of “kicking the can down the road?”

Other Questions

Looking forward, there remain numerous unanswered (perhaps unanswerable) questions as to whether US government Covid-related economic policy of 2020 could have longer lasting unintended consequences well into 2021 and beyond. These include:

- What happens if there is another ‘black swan’ exogenous event in the near-term, with a compounding effect on already-strained government and corporate balance sheets (and an environment where fed funds rates are already effectively at zero, on an inflation adjusted basis), or alternatively, what if the Covid vaccination process towards herd immunity takes much longer time than anticipated?

- What happens if/when federal support (whether explicit or implicit) is removed?

- If the federal government decides to withdraw any explicit/implicit market support, how (what series of events) would it use to do so?

- In actuality, can the federal government ever truly withdraw its implicit ‘guarantee’ of credit markets, now that ‘moral hazard’ has already been introduced (can the bell ever be ‘unrung’?)

- What happens if market credibility/trust in US federal support ultimately decreases, and credit providers effectively call the Fed’s “bluff” and withdraw liquidity from the market (e.g., ignores Fed signaling)?

Clearly, there are no easy answers and only time will tell whether our policy ‘experiment’ of 2020 will have proven to be effective. The only certainty from historical precedent would seem to be that this will not be the last time an exogenous shock will affect both the US and global economic markets, and thus, whatever we can learn from this crisis should help us in some ways in dealing with future exogenous shocks.